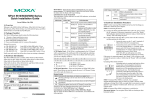

Download Merchant Console User Manual

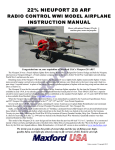

Transcript